Comprehensive Comparison and Selection Guide for 48V Automotive High-Side Switch ICs

2Below is a full comparison and selection guide for automotive-grade 48V board-net high-side switch ICs. The content covers device categories, typi...

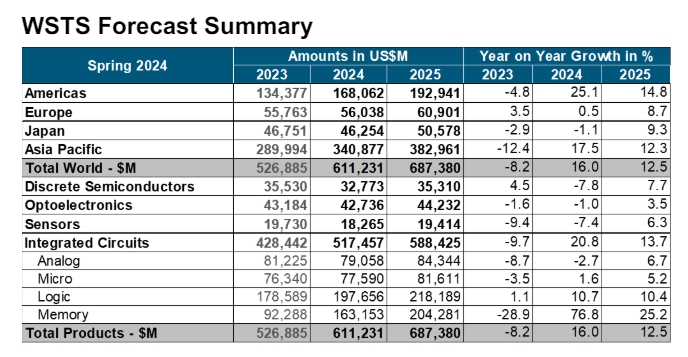

查看全文WASHINGTON—June 6, 2024—The Semiconductor Industry Association (SIA) today announced global semiconductor industry sales were $46.4 billion during the month of April 2024, an increase of 15.8% compared to the April 2023 total of $40.1 billion and 1.1% more than the March 2024 total of $45.9 billion. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. Additionally, a newly released WSTS industry forecast projects annual global sales increases of 16.0% in 2024 and 12.5% in 2025. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

“The global semiconductor industry posted double-digit sales increases on a year-to-year basis during each month of 2024, and worldwide sales in April increased on a month-to-month basis for the first time this year, indicating positive market momentum as we approach the middle of the year,” said John Neuffer, SIA president and CEO. “Additionally, the latest industry forecast projects strong annual growth in 2024, led by sales to the Americas market, which is expected to grow by more than 25% this year.”

Regionally, year-to-year sales in April increased in the Americas (32.4%), China (23.4%), and Asia Pacific/All Other (11.1%), but decreased in Europe (-7.0%) and Japan (-7.8%). Month-to-month sales in April increased in the Americas (4.2%), Japan (2.4%), and China (0.2%), but decreased in Asia Pacific/All Other (-0.5%) and Europe (-0.8%).

Additionally, SIA today endorsed the WSTS Spring 2024 global semiconductor sales forecast, which projects annual global sales will grow to $611.2 billion in 2024, which would be the industry’s highest-ever annual sales total. In 2025, global sales are projected to reach $687.4 billion. WSTS tabulates its semi-annual industry forecast by gathering input from an extensive group of global semiconductor companies that provide accurate and timely indicators of semiconductor trends.

For comprehensive monthly semiconductor sales data and detailed WSTS forecasts, consider purchasing the WSTS Subscription Package. For detailed historical information about the global semiconductor industry and market, consider ordering the SIA Databook.

The World Semiconductor Trade Statistics (WSTS) has released its latest

forecast for the global semiconductor market, anticipating robust growth

in 2024 and 2025.

2024 Forecast: Strong Recovery Expected

WSTS has adjusted its Spring 2024 forecast upwards, projecting a 16.0 percent growth in

the global semiconductor market compared to the previous year. The updated market

valuation for 2024 is estimated at US$611 billion. This revision reflects stronger performance

in the last two quarters, particularly in computing end-markets.

For 2024, mainly two Integrated Circuit categories are anticipated to drive the growth for the

year with double digit increase, Logic with 10.7 percent and Memory with 76.8 percent.

Conversely, other categories such as Discrete, Optoelectronics, Sensors, and Analog

Semiconductors are expected to experience single-digit declines.

The Americas and Asia Pacific regions are projected to see significant growth, with increases

of 25.1 percent and 17.5 percent, respectively. In contrast, Europe is expected to show

marginal growth of 0.5 percent, while Japan is forecasted to see a slight decline of 1.1 percent.

2025 Outlook: Continued Solid Growth

Looking ahead to 2025, WSTS forecasts a 12.5 percent growth in the global semiconductor

market, reaching an estimated valuation of US$687 billion. This growth is expected to be

driven primarily by the Memory and Logic sectors, which are on track to soar to over US$200

billion in 2025 each, representing an upward trend of over 25 percent for Memory and over

10 percent for Logic from the previous year. All other segments are anticipated to record

single-digit growth rates.

2

In 2025, all regions are poised for continued expansion. The Americas and Asia Pacific are

expected to maintain their double-digit growth on a year-over-year basis.

WSTS Forecast Summary

Note: Numbers in the table are rounded to whole millions of dollars, which may cause totals by region and

totals by product group to differ slightly.

Below is a full comparison and selection guide for automotive-grade 48V board-net high-side switch ICs. The content covers device categories, typi...

查看全文Power semiconductor technology firm ROHM states that it serves as one of the key silicon providers supporting NVIDIA's new 800V High-Voltage Direct...

查看全文Amid persistent macroeconomic uncertainty and cyclical market softness, discrete device designer and manufacturer Nexperia of Nijmegen, the Netherl...

查看全文Shanghai Chipanalog Microelectronics Co., Ltd. is a high-tech company focusing on R&D, design and sales of high-end analog chips. The product portf...

查看全文 0

0High Quality IC Suppliers

您好!请登录